Analysis and Trend Forecast of the Medical RFID Market from 2025 to 2035

123The Medical RFID Market is projected to grow steadily from 2025 to 2035. This report covers market size, CAGR, key drivers, technology trends, and regional outlook.

MoreAll RFID Product

When we started tracking the RFID smart cabinets sector several years ago, it was still treated as a niche solution—mostly used in a small number of hospitals and industrial tool rooms. That picture has changed noticeably over the past two to three years.

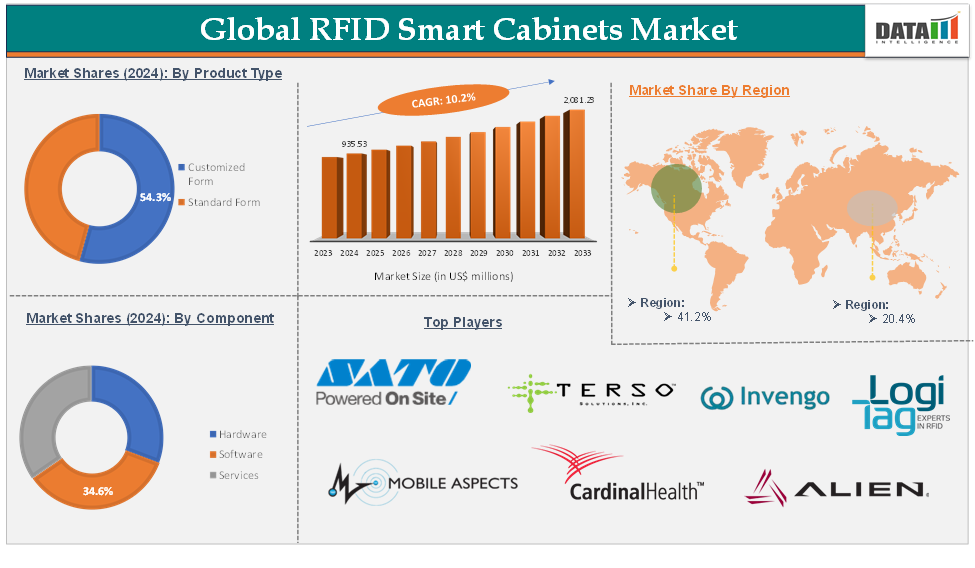

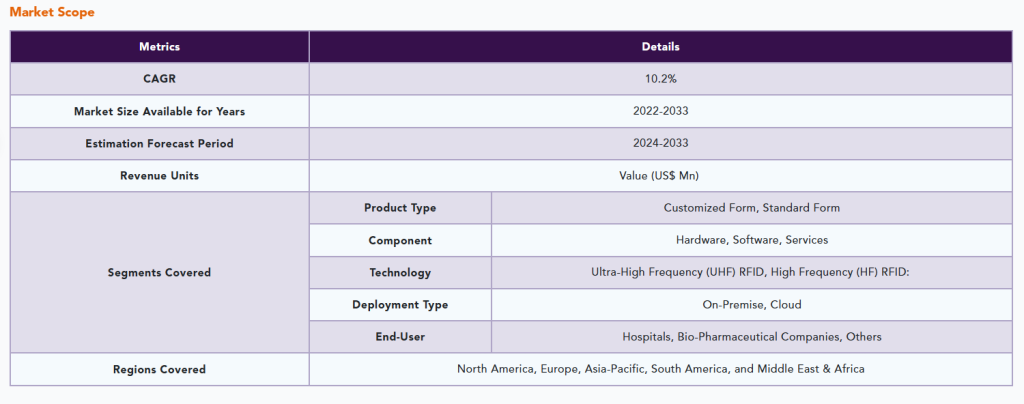

Based on our latest consolidated data, the global RFID smart cabinets market reached US$ 935.53 million in 2023. If current adoption patterns continue, the market is likely to exceed US$ 2.08 billion by 2033, which translates into a long-term growth rate of roughly 10% per year.

On paper, this looks like a typical mid-growth technology market. In practice, the drivers behind that growth are far more operational than technological.

In interviews with hospitals, pharmaceutical warehouses, and industrial operators, the same issue comes up repeatedly: inventory is visible on spreadsheets, but invisible in real life.

RFID smart cabinets address a very practical gap. They do not just store items; they record who took what, when it was taken, and whether it was returned. That sounds basic, but in environments dealing with high-value tools, controlled drugs, or sensitive documents, this level of visibility is often missing.

This is one reason hospitals remain the largest users. Real-time tracking of medical supplies, implants, and emergency stock reduces both waste and compliance risk. Similar logic applies to industrial tool cabinets and police equipment storage, where accountability matters more than convenience.

Manufacturers such as CYKEO have expanded beyond generic cabinet designs and now offer application-specific systems like RFID Medical Cabinets, RFID Tool Cabinets, RFID Archive Cabinets, and RFID Police Cabinets. This shift toward scenario-based design reflects how buyers actually think: they are purchasing a workflow solution, not just hardware.

From a revenue standpoint, hardware still accounts for the largest share of the market. RFID tags alone are expected to represent about 34.6% of total market value in 2024, largely because every cabinet deployment requires hundreds or thousands of tagged items.

However, the more interesting trend appears after installation. End users increasingly focus on:

This is where software and services quietly grow in importance. Several buyers admitted that, while hardware justified the initial purchase, software insights are what keep the system in place long term.

Ultra-high frequency (UHF) RFID dominates most deployments simply because it reads multiple items quickly and works well in bulk storage environments. This makes it suitable for medical supply rooms and industrial settings.

High-frequency (HF) RFID still has a role, particularly in archives, libraries, and document storage, where shorter read ranges reduce accidental reads and improve precision. RFID Library Cabinets and RFID Archive Cabinets fall clearly into this category.

The technology decision is rarely ideological. Most buyers choose based on room size, item density, and error tolerance.

North America continues to lead the market and is expected to represent around 41.2% of global demand in 2024. This dominance is not only about technology readiness. It is also driven by strict compliance standards, particularly in healthcare, where medication errors and missing equipment carry legal consequences.

Asia Pacific, by contrast, shows faster adoption momentum. Government-backed digital healthcare programs in Japan, China, and India are accelerating RFID deployments. Regional healthcare spending is projected to reach US$ 2.3 trillion by 2030, and a growing share of that budget is tied to automation and digital infrastructure.

In this region, RFID smart cabinets are often introduced as part of broader modernization projects rather than as standalone investments.

The market includes well-known names such as SATO, WaveMark (Cardinal Health), Terso Solutions, Impinj, and Invengo, alongside specialized solution providers. Competition is less about who has the best RFID tag or RFID reader, and more about who understands real operational pain points.

Vendors that can adapt cabinet design, software logic, and deployment models to specific environments—medical, industrial, archival, or public safety—are gaining ground faster than those offering generic systems.

What to Expect Going Forward

Looking ahead to 2033, the RFID smart cabinets market is unlikely to see explosive growth, but it does not need to. Its strength lies in steady, repeatable adoption across industries where inventory errors are expensive.

The next phase of growth will likely come from:

In short, RFID smart cabinets are becoming less of a “technology purchase” and more of a standard operational tool.

The Medical RFID Market is projected to grow steadily from 2025 to 2035. This report covers market size, CAGR, key drivers, technology trends, and regional outlook.

MoreRFID-integrated smart packaging market forecast from 2025 to 2035, covering market size, CAGR, technology trends, applications, and regional growth insights.

MoreAn in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreThe RFID blood monitoring system market is projected to grow from USD 127.4 million in 2024 to USD 234.7 million by 2034, driven by traceability requirements, hospital digitization, and regulatory compliance in blood management.

More