Starting Point

When people talk about Radio Frequency Identification, they often describe it as a mature technology. In some sense this is true. RFID has existed for decades, and many early applications were simple, sometimes even crude. Access cards, warehouse labels, library books. That was the first phase.

But the way RFID is being used today is different. Not because the basic principle changed, but because the environment around it changed. Costs went down. Systems became easier to integrate. At the same time, companies started caring more about visibility and traceability than before. This combination is what really pushed RFID forward.

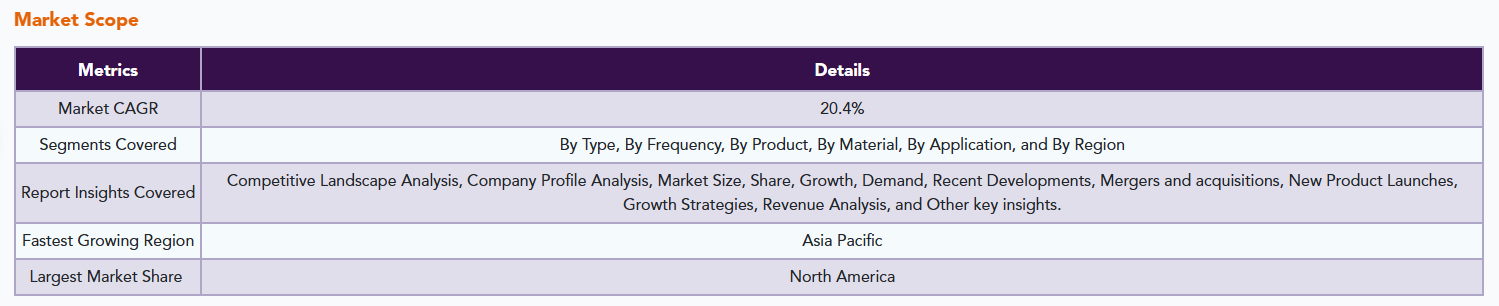

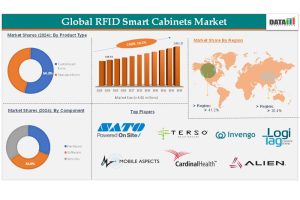

Market Size – How the Numbers Are Usually Interpreted

In 2023, the global RFID market was valued at roughly US$ XX million. Different research groups give slightly different numbers, but most estimates fall into a similar range. What matters more than the exact figure is the direction.

Looking ahead to 2030, market size is expected to reach around US$ XX million, with an estimated CAGR close to 20.4% between 2024 and 2031. This sounds aggressive, and in some segments it probably is. Growth is not evenly spread. Some sectors move fast, others barely move at all.

In practice, RFID growth usually happens in waves. A company delays adoption for years, then suddenly deploys RFID across multiple sites in a single project.

How RFID Is Actually Classified in the Field

By Tag Type

Most discussions divide RFID into:

- Active

- Passive

- Battery-assisted passive (BAP)

From what is seen in real deployments, passive RFID dominates, mainly because of cost and simplicity. Active RFID is useful, but only when there is a clear reason to pay more. BAP sits somewhere in between and is still relatively niche.

By Frequency

RFID operates on different frequency bands:

UHF RFID is the most visible in logistics and industrial tracking. It allows bulk reading, and that alone changes workflow design. HF still holds its place in access control and some healthcare use cases. LF is limited but stable.

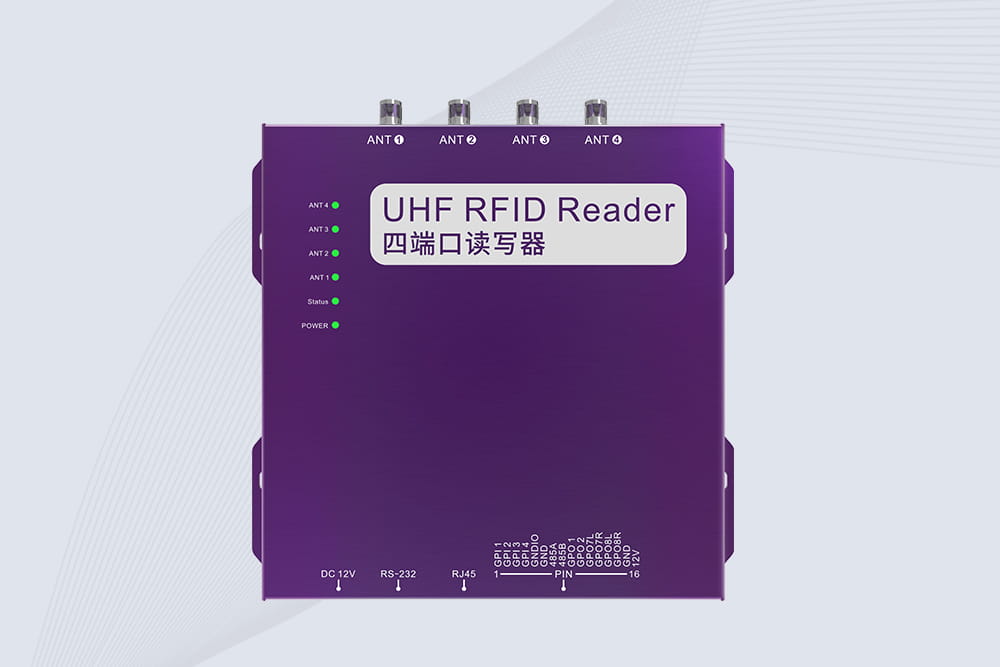

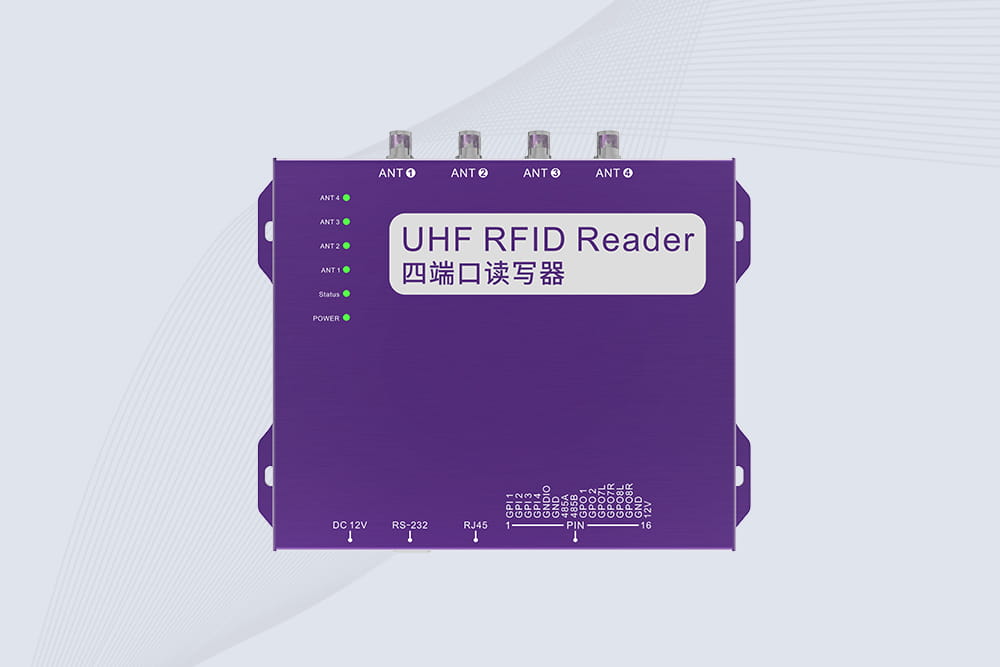

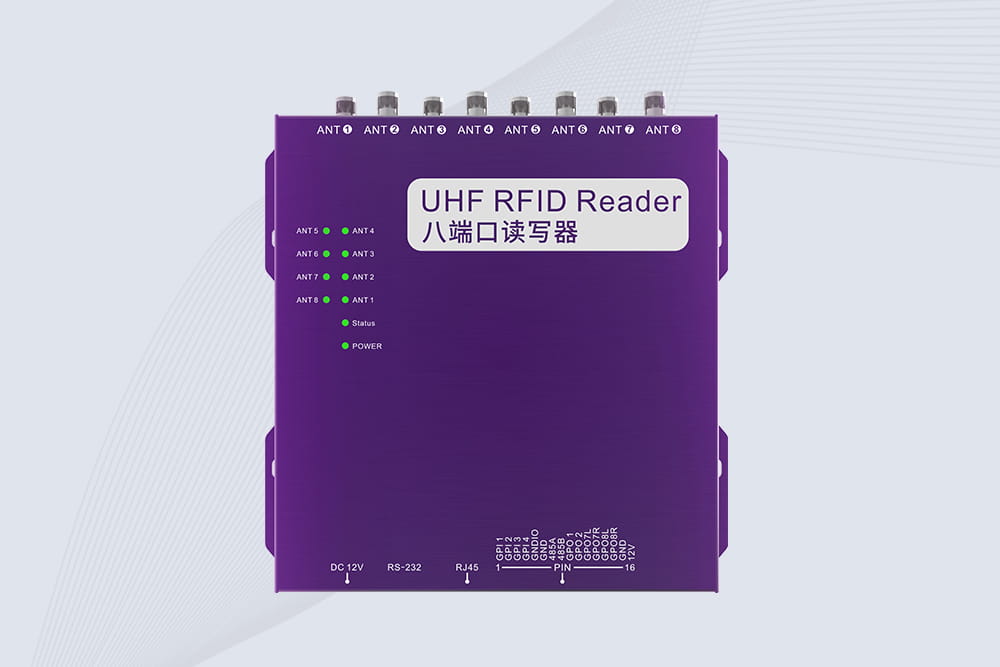

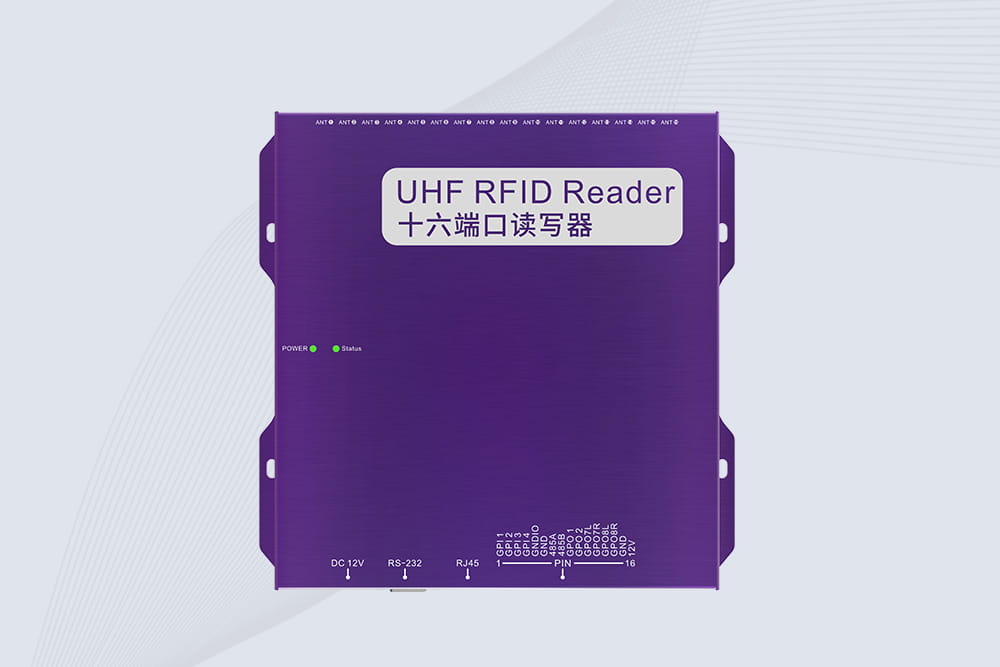

Product-Level Reality

RFID products are usually listed as RFID tags, RFID readers, and RFID antennas. On paper, that looks simple. In real projects, it rarely is.

Many deployments now involve integrated systems, especially in controlled environments. RFID smart cabinets are a good example. These systems combine readers, antennas, enclosures, and software logic into one solution. Hospitals, tool rooms, archives, and police evidence rooms often prefer this approach.

Companies like CYKEO are positioned in this segment, offering RFID smart cabinets alongside readers, antennas, modules, and tags. This type of supplier usually works closer to system integrators than to pure component distributors.

Technology Changes That Actually Matter

RFID chips have become smaller. That fact is repeated often, but it does matter. Some modern chips are around 125 micrometers, which makes it easier to embed RFID into labels, plastics, and even electronic parts.

Another change is cost. Tags that were once considered too expensive for disposable use are now common in retail and logistics. Circuit designs are also more flexible. RFID can now coexist with other semiconductor functions in a single product.

There are also research efforts that never fully reach mass adoption but still influence the industry. MIT’s Auto-ID Labs released a UHF RFID tag-sensor system years ago that could detect glucose changes. Projects like this don’t become products immediately, but they shape expectations.

Why Security Keeps Coming Up

RFID itself does not store large amounts of data on the tag. That is often misunderstood. The bigger risk sits elsewhere.

Most RFID systems today rely on networked backends, often cloud-based. That is where data aggregation happens. Inventory records, usage logs, access histories. If that layer is compromised, RFID becomes part of a much larger problem.

This is one reason why adoption in healthcare and government environments tends to be slow and cautious. The technology is accepted, but the system architecture must pass internal reviews.

COVID-19 Was a Pause, Not a Reset

During 2020, RFID projects slowed down. Manufacturing delays, installation restrictions, budget freezes. All of that happened.

But in healthcare, something else happened at the same time. RFID helped reduce physical contact, speed up asset tracking, and support temporary workflows. That experience changed how some organizations viewed automation.

After restrictions eased, RFID projects resumed, often with clearer justification than before.

Passive RFID – Still the Workhorse

A standard passive RFID system includes a tag, a reader, and an antenna. The RFID tag has no battery. It takes energy from the reader’s signal, sends data back, and that’s it.

Read range is usually 3–5 meters. This is enough for doors, cabinets, shelves, and workstations. Longer range is possible, but not always needed.

Passive tags are cheap, standardized, and widely supported. That combination is hard to beat. Active RFID exists for specific use cases, but passive remains the default choice.

Regional Differences Are Real

North America remains one of the largest RFID markets. In the U.S., RFID is widely used in logistics and healthcare. Hospitals use it for equipment tracking, inventory control, and sometimes patient workflows.

Government support for health IT indirectly supports RFID adoption. When digital infrastructure improves, RFID becomes easier to justify.

Asia-Pacific shows different dynamics. Cost sensitivity is higher. Volumes are larger. Europe often emphasizes compliance and infrastructure alignment.

Competitive Landscape – No Single Dominant Player

The RFID market does not have one company controlling everything. Instead, there are chip vendors, tag manufacturers, reader suppliers, and system integrators.

In 2022, Impinj joined the DoseID Consortium to support RAIN RFID in healthcare. Identiv continues to expand its RFID portfolio, including tag-on-metal products for industrial environments.

At the same time, solution-focused companies working on readers, antennas, modules, and smart cabinets fill practical gaps. CYKEO fits into this category, focusing on applied RFID systems rather than pure component scale.

Final Notes

RFID growth is real, but it is uneven. The technology is stable, but adoption depends heavily on context. Some projects succeed quickly. Others take years.

Looking forward to 2031, RFID will continue to spread, mostly quietly, often without headlines. That is usually how infrastructure technologies grow.

Related UHF RFID Fixed Reader

Cykeo RFID IoT Solution Products R&D Manufacturer

Cykeo RFID IoT Solution Products R&D Manufacturer