RFID Printer Market Outlook 2025–2035: What Is Actually Changing

47An in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreAll RFID Product

I. Quick Statistics on the RFID Tester Market

II. Key Points of the RFID Tester Market

| Measurement & Specification | Value |

|---|---|

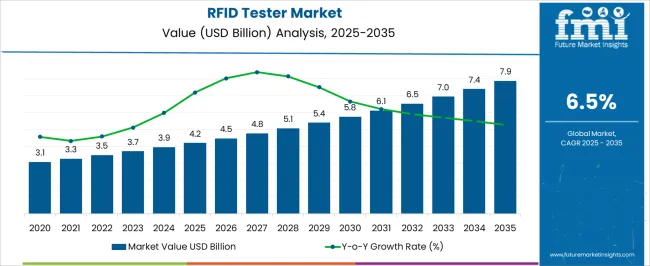

| Estimated Value of RFID Tester Market (2025E) | US$4.2 billion |

| Forecasted Value of RFID Tester Market (2035F) | US$7.9 billion |

| CAGR Forecast (2025-2035) | 6.5% |

III. Why is the RFID tester market growing?

The RFID tester market is experiencing strong growth as organizations increasingly rely on RFID systems for inventory management, asset tracking, security, and process automation. The current market situation reflects the widespread adoption across industries, where accurate and efficient testing of RFID tags and readers is crucial for operational reliability.

In 2025, the market will be driven by technological advancements in RFID solutions, such as improved tag sensitivity, advanced reading protocols, and the integration of software-defined testing platforms. Demand for testing solutions will be supported by improvements in supply chain optimization, compliance, and asset visibility.

Furthermore, the increasing application of RFID in aerospace and defense, logistics, retail, and manufacturing sectors has spurred demand for high-precision testing equipment to ensure performance, durability, and interoperability. As industries transition to automated and intelligent tracking systems, the RFID test equipment market is expected to continue expanding, providing opportunities for testers capable of supporting multi-band, high-speed verification and real-time analysis, while reducing errors and downtime.

IV. Segmented Analysis

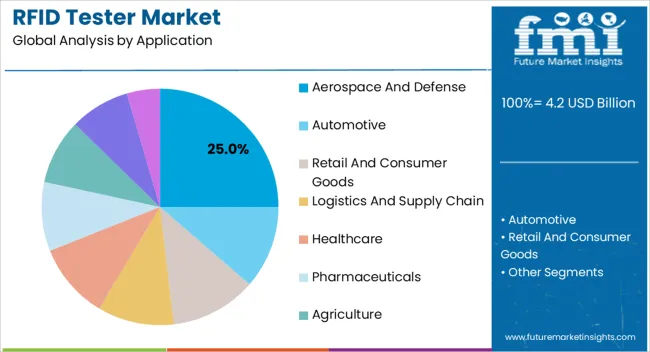

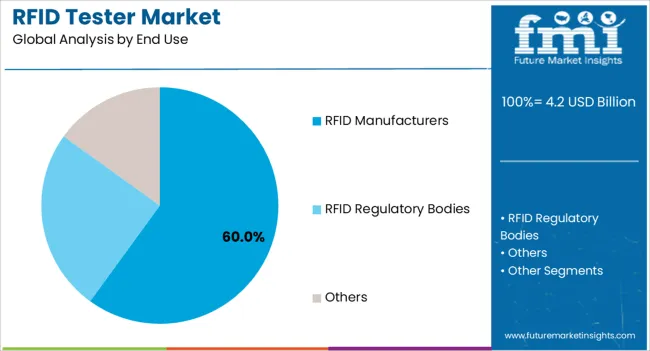

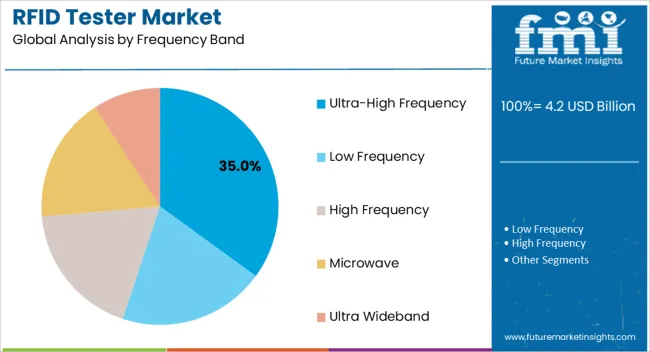

The RFID tester market is segmented by application, end-use, frequency band, and geographic region. By application sector, the RFID tester market is divided into aerospace and defense, automotive, retail and consumer goods, logistics and supply chain, healthcare, pharmaceuticals, agriculture, government, and others. In terms of end-use, the RFID tester market is divided into RFID manufacturers, RFID regulatory agencies, and others. By frequency band, the RFID tester market is divided into UHF, LHF, HF, microwave, and UHF. Geographically, the RFID tester industry is divided into North America, Latin America, Western Europe, Eastern Europe, the Balkans and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and the Pacific, and the Middle East and Africa.

1、Insights into Aerospace and Defense Applications

The aerospace and defense applications segment is projected to account for 25.00% of the RFID tester market revenue by 2025, becoming the leading application segment. This growth is driven by the urgent need for highly reliable RFID systems in defense equipment, air logistics, and security inventory tracking. RFID testers are favored because they can verify tag readability, signal strength, and durability under extreme environmental conditions, all of which are crucial for aerospace and defense operations.

The complexity of the industry’s supply chain makes accurate testing indispensable to ensure compliance with industry standards and operational safety. Increased investment in automated logistics, defense infrastructure, and high-value asset tracking has further driven growth in this segment.

RFID testers are able to perform tests quickly and repeatably, while supporting emerging protocols and tag types, reinforcing their leadership position in this segment. Demand for high-performance RFID test solutions is expected to remain strong as the aerospace and defense industries continue to modernize.

2、Insights into RFID manufacturers’ end-use segments

The RFID manufacturer end-use segment is projected to account for 60.00% of market revenue by 2025, making it the largest end-use industry for RFID testers. This dominance stems from the need for stringent quality assurance and performance verification during the manufacturing process of RFID tags and readers. This requirement, driven by the need to meet global compliance standards, reduce product failures, and ensure interoperability across multiple systems and frequency bands, is accelerating adoption.

RFID testers provide manufacturers with tools to measure signal strength, read/write performance, and environmental resilience of devices before deployment. The ability to quickly and efficiently test large numbers of tags and readers reduces operating costs and increases productivity.

Manufacturers are increasingly investing in automated and software-driven test platforms to maintain high throughput while ensuring accuracy. As the RFID market continues to expand in retail, transportation, and defense sectors, manufacturers’ demand for reliable and versatile test solutions is expected to remain a leading factor in this segment.

3、Insights into the Ultra-High Frequency Segment

The UHF segment is projected to account for 35.00% of the RFID tester market revenue by 2025, becoming the leading segment in the frequency band field. This growth is driven by the widespread deployment of UHF RFID systems for remote tracking, warehouse management, and supply chain visualization.

UHF RFID testers are popular because they can accurately measure read range, signal integrity, and performance under real-world conditions, ensuring tags and readers operate efficiently over long distances. The higher throughput of UHF technology compared to lower frequency bands has fueled this application in industries requiring rapid scanning and automated inventory processes.

The flexibility of UHF testers, supporting multiple tag protocols, environmental conditions, and dynamic testing scenarios, further enhances this segment. As supply chains, logistics, and manufacturing operations increasingly rely on high-speed and long-range RFID solutions, the UHF segment is expected to maintain its market leadership through robust testing and quality assurance practices.

V. Overview of the RFID Tester Market

The increasing prevalence of RFID technology has driven the demand for RFID testers and significantly boosted the global RFID tester market. RFID is a wireless technology that uses electrostatic or electromagnetic coupling in the radio frequency (RF) portion of the electromagnetic spectrum for identification. Multiple standards have been developed to ensure the workability of products worldwide.

RFID testers read passports, cards, smartphones, readers, and other electronic devices to check for compliance. The growing demand for RFID technology in the healthcare sector is one of the main drivers of the global RFID tester market. In the healthcare field, there is increasing focus on the use of RFID technology for medical device tracking and classification, which is expected to drive demand for RFID testers.

The demand for RFID testers is growing as RFID technology helps improve supply chain efficiency, ensure patient safety, and reduce human error in healthcare processes.

The retail industry is another potential segment for RFID testers. The growing demand for RFID technology in the retail sector to reduce supply chain complexity is driving the growth of the global RFID tester market. The increasing need for efficient supply chain operations within the retail industry is fueling the demand for RFID technology and significantly boosting the RFID tester market.

Retail stores are deploying RFID tags and RFID readers for security, preventing theft and loss. Businesses are increasingly adopting automated merchandise identification systems for supply chain management to improve inventory allocation efficiency. This growing demand for efficient supply chain management is expected to support growth in the RFID and RFID testing equipment market during the forecast period.

Furthermore, it is a cost-effective and efficient operational solution. Multiple developments in the RFID testing technology field are expected to drive the growth of the global RFID testing market during the forecast period.

VI. Analysis of the RFID Tester Market by Major Country

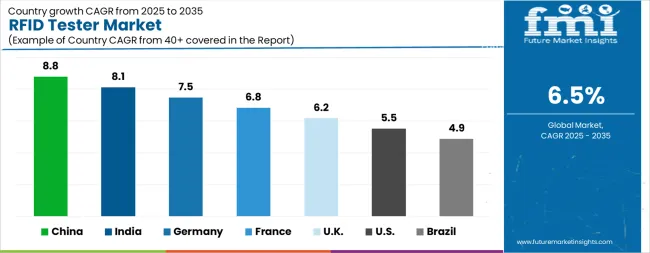

| Rural areas | Compound Annual Growth Rate |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

VII. Analysis by Country

The RFID tester market is projected to grow at a CAGR of 6.5% during the forecast period, exhibiting diverse momentum across different countries. China leads with the highest CAGR of 8.8%, followed closely by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the US is likely to maintain stable growth. Brazil has the lowest CAGR at only 4.9%, but this still indicates a positive overall trend in the global RFID tester market. In 2024, Germany dominated revenue in Western Europe, with a projected CAGR of 7.5%. The US RFID tester market is estimated at $1.6 billion in 2025 and is projected to reach $2.7 billion by 2035. Sales are expected to grow at a CAGR of 5.5% during the forecast period from 2025 to 2035. The Japanese and South Korean markets are projected to be valued at $206.8 million and $130.2 million respectively in 2025.

An in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreExplore the global low-frequency RFID tag market from 2026 to 2036, including market size, growth outlook, technology and application segmentation, country-level CAGR analysis, and competitive landscape insights.

MoreAn in-depth analysis of the global RFID market from 2024 to 2031, covering technology evolution, market structure, passive vs active RFID, and real-world adoption trends.

MoreThe RFID blood monitoring system market is projected to grow from USD 127.4 million in 2024 to USD 234.7 million by 2034, driven by traceability requirements, hospital digitization, and regulatory compliance in blood management.

More