RFID Printer Market Outlook 2025–2035: What Is Actually Changing

47An in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreAll RFID Product

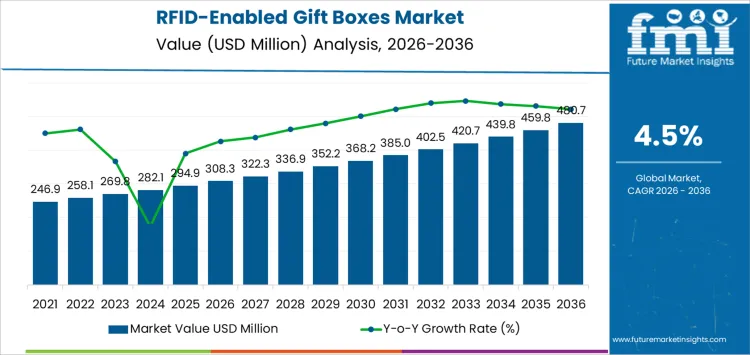

According to Future Market Insights, the RFID-enabled gift box market was valued at $308.3 million in 2026 and is projected to reach $480.7 million by 2036, representing a CAGR of 4.5%. In the first five years from 2026 to 2031, the market value is expected to rise to approximately $384.3 million. This phase reflects the structured adoption of NFC tags and high-end hard boxes in luxury retail and electronic gifting, supporting authentication, inventory tracking, and brand interaction. Growth remains gradual, primarily relying on selective deployment of high-value gift formats rather than widespread replacement of traditional packaging.

Between 2031 and 2036, the market size expands from approximately $384.3 million to $480.7 million, forming the second growth segment with a higher absolute growth rate. With the standardization of RFID integration in high-end packaging lines, corporate gifts, event merchandise, and special edition packaging also contribute stable sales volumes. UHF RFID and embedded smart tags are widely used alongside NFC. This segment reflects increased production scale and repeat orders from existing customers; growth primarily relies on packaging upgrades and value-added features rather than an expansion in the overall quantity of gifts.

I. Quick Market Statistics for RFID-Supporting Gift Boxes

II. What are the growth forecasts for the RFID-supported gift box market up to 2036?

The RFID-enabled gift box market is projected to grow from $308.3 million in 2026 to approximately $367.7 million in 2031, reflecting adoption based on brand protection and inventory visibility rather than simply the quantity of gifts. Early growth was concentrated in high-end confectionery, cosmetics, and corporate gifting programs, which enhanced measurable value through certification and traceability. During this phase, RFID was typically used selectively for limited editions and seasonal events. YeAR’s year-over-year revenue gradually increased as packaging converters improved integration methods, enhanced the reliability of reading decorative materials, and aligned unit prices with mid-range product pricing.

Between 2031 and 2036, the market size is projected to expand from approximately $367.7 million to $480.7 million, marking a more pronounced shift towards large-scale adoption. Growth accelerates as RFID-enabled boxes become the standard for omnichannel fulfillment, returns management, and post-purchase interaction. Brands are increasingly leveraging embedded tags for anti-steering controls, lifecycle tracking, and personalized content activation. Annual added value increases as adoption expands from luxury goods to broader retail gifts, driven by higher tag volumes, improved retail system interoperability, and repeated deployments of packaging projects across multiple markets.

III. Key Summary of Supporting the RFID Gift Box Market

| Measurement | Value |

|---|---|

| Market Cap (2026) | $308.3 million |

| Projected Value (2036) | $480.7 million |

| CAGR Forecast (2026-2036) | 4.5% |

IV. How can smart packaging strategies drive the development of the RFID gift box market from 2026 to 2036?

As high-end brands move beyond decorative packaging and focus on the functional value of gift formats, RFID-enabled gift boxes are gaining traction. Premium food, beverage, cosmetics, and promotional items utilize RFID tags to support controlled distribution and inventory visibility during seasonal peaks. Historical demand reflects needs for inventory accuracy, shrinkage reduction, and authentication throughout the gift retail cycle. Packaging designers are discreetly integrating RFID, maintaining visual appeal while enabling backend tracking. Adoption is primarily concentrated in limited editions, corporate gifts, and duty-free retail—sectors where visibility and provenance are paramount.

From 2026 to 2036, demand is projected to expand as smart packaging becomes an integral part of brand operations, rather than a novelty. RFID-enabled gift boxes support logistics automation, returns verification, and event-based gifting campaigns. This growth aligns with omnichannel fulfillment and data-driven retail planning. Manufacturers will refine recyclable materials and thinner inserts to reduce costs and improve compatibility. Buyers will evaluate system integration, data ownership, and lifecycle management when selecting RFID packaging solutions.

V. What will be the market demand for RFID-enabled gift boxes by application and product type from 2026 to 2036?

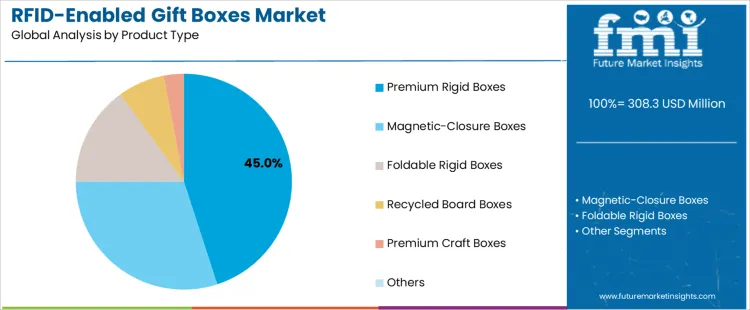

From 2026 to 2036, the market for RFID-enabled gift boxes continues to expand, with brands adopting smart packaging to support authentication, inventory visibility, and engagement with high-end customers. Luxury retail accounts for 40% of application demand, as high-value gifts emphasize provenance tracking, tamper-proof guarantees, and post-purchase interaction. High-end rigid boxes lead product type adoption with a 45% share, offering structural integrity, display quality, and sufficient space to install concealed RFID embeddings. Demand reflects the integration of packaging with digital retail systems, controlled distribution, and enhanced brand narratives.

1、Why will RFID gift boxes account for 40% of the demand in the luxury retail market, by application, between 2026 and 2036?

Luxury retail accounts for 40% of demand, as high-end brands require packaging that supports certification and controlled distribution across an omnichannel environment. Watches, jewelry, perfumes, and designer accessories are high-intensity purchases, with these gifts aligning with seasonal new arrivals and limited editions. Usage remains stable as RFID enables product-level tracking from order fulfillment to point of sale and after-sales service. Purchasing decisions prioritize tag concealment, signal reliability, and compatibility with existing retail infrastructure. Buyers prefer solutions that guarantee inventory accuracy and theft prevention without sacrificing aesthetics. Price sensitivity remains moderate, as packaging represents only a small fraction of product value while providing operational benefits. Regulatory controls focus on achieving tag readability, handling durability, and data security standards through dense materials. Demand continues from 2026 to 2036 as luxury retailers expand connected packaging initiatives to enhance inventory control and customer experience. Repeat usage remains predictable due to regular gifting cycles and advanced product update programs.

2、Why will high-end rigid boxes account for 45% of the demand for RFID-enabled gift boxes by product type between 2026 and 2036?

High-end rigid cases account for 45% of demand because they provide the structural stability needed to protect high-value items while securely storing RFID components. Consumption is particularly strong in applications where display quality and the unboxing experience impact brand perception. Usage remains stable, with rigid formats able to withstand the stress of shipping and repeated handling without affecting tag performance. Purchasing preferences allow for box structures that integrate RFID between board layers or within the enclosure, ensuring concealment and signal consistency. Buyers prioritize materials that support fine finishes, embossing, and linings without interfering with RF transmission. Price sensitivity remains moderate, as rigid cases offer durability and reusability potential. Specification controls emphasize board density, adhesive compatibility, and tolerance to shielding effects. Demand continues from 2026 to 2036 as brands combine high-end packaging with digital traceability and higher gifting standards in the luxury and corporate segments.

六、How can RFID-enabled gift boxes be integrated into retail and brand fulfillment workflows?

Tracking and authentication are critical in high-end retail, corporate gifts, and event merchandise displays. Luxury retailers embed RFID tags in gift boxes to manage inventory in flagship stores and pop-up shops. Corporate gift companies use this data to confirm delivery status for high-volume events. Event organizers use RFID-enabled packaging to monitor distribution during sponsored promotions. Subscription box services integrate tags to improve warehouse picking accuracy. These uses reflect operational needs related to traceability, loss reduction, and controlled distribution, going beyond mere decorative packaging.

1、What business conditions support the adoption of RFID gift boxes?

The choice aligns with environments requiring visibility beyond the point of sale. Retail chains use RFID boxes to connect packaging to their inventory management systems. Brand owners use this data to verify the authenticity of limited editions. Logistics teams handling high-value gifts rely on RFID to reduce manual scanning during shipping. Marketing teams use tagged boxes in controlled handouts to measure engagement during campaigns. These conditions facilitate solutions that connect physical packaging with digital records, supporting coordination across sales, logistics, and brand operations.

2、What factors limit the widespread use of RFID gift boxes?

Cost remains a significant consideration for mass-market gift formats. Integration needs to be consistent with existing inventory and point-of-sale systems. Small retailers often lack the technical expertise to effectively manage tag data. Recycling issues arise when RFID components complicate disposal. Privacy expectations also impact consumer-facing campaign usage. Tag damage during handling reduces reliability. These factors lead to deployment selectivity, with added complexity and cost justifying value tracking, brand positioning, and system readiness.

各国对RFID礼品盒的需求如何?

七、What is the demand for RFID gift boxes in different countries?

| Rural Areas | Compound Annual Growth Rate (%) |

|---|---|

| USA | 9.5% |

| China | 12.0% |

| Germany | 7.8% |

| India | 11.1% |

| Japan | 6.0% |

| Brazil | 7.2% |

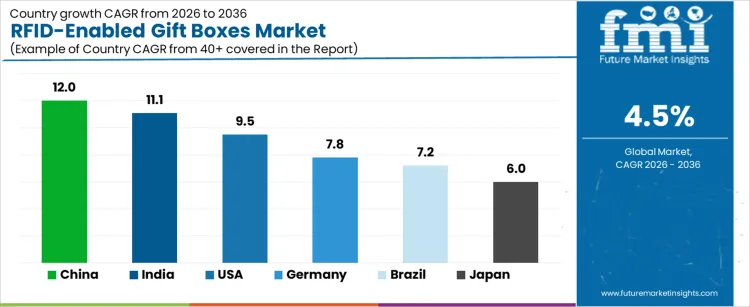

Demand for RFID-enabled gift boxes varies by country, influenced by retail digitalization, the trend towards premium gifts, and the need for logistics tracking. China leads with a CAGR of 12.0%, driven by the proliferation of e-commerce gifts, the rise of luxury brands, and the widespread adoption of smart packaging in retail distribution. India follows closely with 11.1%, primarily driven by organized retail expansion, holiday gift promotions, and the increasing popularity of traceable packaging formats. The US market grew by 9.5%, reflecting the adoption of premium brands seeking inventory visibility and anti-theft features. Germany achieved 7.8%, benefiting from structured retail supply chains. Brazil grew by 7.2%, driven by organized retail growth, while Japan grew by 6.0%, reflecting the adoption of mature packaging and retail technologies.

1、How will the adoption of smart packaging boost demand for gift packaging in the United States?

In the US, the RFID-enabled gift box market is projected to grow at a CAGR of 9.5% until 2035, driven by the increasing adoption of smart packaging in the premium gift and branded merchandise segments. Retailers and brand owners are integrating RFID-enabled gift boxes to enhance inventory tracking, authentication, and consumer interaction. Demand is concentrated in luxury, corporate gifts, and high-value retail packaging, sectors that support loss prevention through traceability. Domestic packaging converters are partnering with RFID solution providers to offer integrated packaging formats. The growth of omnichannel retail fulfillment and experiential packaging projects continues to drive sourcing activities for major retailers and brand owners nationwide.

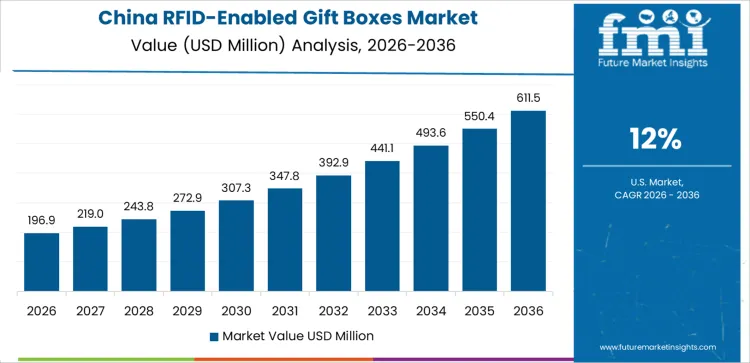

2、How can digital retail infrastructure accelerate China’s growth?

In China, the RFID gift box market is projected to grow at a CAGR of 12% until 2035, driven by the rapid expansion of digital retail infrastructure and demand for premium product packaging. Brands are adopting RFID-enabled boxes to enhance supply chain visibility and product authentication across online and offline channels. Demand is strong for cosmetics, electronics gifts, and seasonal promotional packaging. Domestic manufacturers are scaling up production by integrating electronics and packaging capabilities. High e-commerce volumes and brand protection priorities are driving rapid adoption across major retail and gift projects nationwide.

3、How can structured packaging innovation support Germany’s needs?

Germany’s RFID gift box market is projected to experience a compound annual growth rate (CAGR) until 2035, driven by structured packaging innovation and a strong focus on logistical efficiency. Manufacturers are integrating RFID-enabled boxes to improve traceability and handling accuracy within retail distribution networks. Demand is primarily concentrated in high-end consumer goods, electronics, and branded gift packages. Packaging engineering expertise supports reliable RFID integration. Stable demand from established brands and organized retail systems maintains predictable sourcing patterns for domestic packaging suppliers.

4、Why is the culture of high-end gifting driving India’s growth?

India’s RFID gift box market is growing at a CAGR of 11.1%, driven by the growing culture of premium gifting and rising consumption of branded goods. Businesses are adopting RFID-enabled boxes to enhance presentation and manage inventory for corporate gifts and holiday sales. Demand is increasing for packaging for apparel, electronics, and personal care gifts. Home conversion companies are partnering with technology providers to offer cost-aligned solutions. The expansion of organized retail and the rise in gift consumption are driving steady adoption in urban markets across the country.

Japan’s RFID gift box market is projected to maintain steady growth at a CAGR of 6% until 2035, driven by the controlled adoption of smart packaging in high-end retail formats. Brands will selectively use RFID-enabled boxes to improve handling accuracy and product verification. Demand remains concentrated in luxury goods, electronics, and seasonal gift packaging. Domestic suppliers emphasize precise integration and consistent quality. Stable retail sales and replacement-driven usage enable predictable sourcing across a mature national gift market.

5、How can brand differentiation strategies support growth in Brazil?

Brazil’s RFID gift box market is projected to grow at a CAGR of 7.2% through 2035, driven by increasing focus on brand differentiation and premium packaging formats. Companies use RFID-enabled boxes to enhance product presentation and manage distribution across retail channels. Demand is rising for cosmetics, apparel gifts, and promotional packaging. Imported suppliers provide some RFID components, while local converters expand box production capacity. Expanding consumer goods distribution and promotional activities continue to drive demand in the national branded gift application market.

八、How is the demand for RFID-enabled gift boxes developing? Which packaging companies are influencing brand adoption?

As brands seek better inventory visibility, theft control, and after-sales interaction for high-end products, RFID-enabled gift boxes are emerging. Luxury, electronics, cosmetics, and seasonal gift segments are leveraging embedded RFID technology to track movement from warehouse to retail shelf while maintaining display quality. Avery Dennison plays a key role by cleverly integrating RFID embeddings and tags into the box structure. Topprint supports the adoption of printed electronics and smart packaging formats used by high-value brands in Japan and overseas markets. YUTO Packaging designs rigid yet foldable gift boxes that can accommodate RFID components without compromising aesthetics. DS Smith is involved in aligning smart packaging with omnichannel retail logistics and traceability needs. ITC Packaging supports adoption through premium board boxes used for gifts and promotional activities.

Design and sourcing decisions are influenced by readability accuracy, label concealment, recyclability, and compatibility with automated packaging lines. Brand owners prioritize boxes that allow for in-store inventory checks without opening the packaging. Retailers prioritize faster inventory reconciliation and improved loss prevention during peak gift seasons. Packaging teams focus on maintaining tactile quality while embedding smart features. Applications include holiday gift sets, limited-edition releases, corporate gifts, and high-value subscription boxes. Demand visibility tracks the growth of connected retail, the expansion of RFID applications beyond the apparel market, and the increased emphasis on transparency in the supply chain for premium packaged goods.

An in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreAn in-depth analysis of the global RFID market from 2024 to 2031, covering technology evolution, market structure, passive vs active RFID, and real-world adoption trends.

MoreRFID tester market forecast from 2025 to 2035, covering market size, CAGR, applications, frequency bands, regional growth, and competitive landscape.

MoreRFID-integrated smart packaging market forecast from 2025 to 2035, covering market size, CAGR, technology trends, applications, and regional growth insights.

More