RFID Printer Market Outlook 2025–2035: What Is Actually Changing

49An in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreAll RFID Product

The RFID market in pharmaceuticals is experiencing significant growth, driven by increasing emphasis on ensuring drug authenticity, traceability, and patient safety across the global pharmaceutical supply chain. The adoption of RFID technology is fueled by the growing prevalence of counterfeit drugs, stringent regulatory frameworks, and the need for real-time visibility into drug inventory.

The integration of RFID systems enables automated data collection, improving logistical efficiency, reducing medication errors, and thus enhancing operational transparency. Pharmaceutical companies are increasingly investing in RFID-enabled tracking solutions to improve supply chain visibility and compliance with serialization requirements.

The ongoing transformation towards digital healthcare infrastructure and advancements in RFID sensor technology are expanding its applications from packaging and logistics to clinical trials and hospital management systems. As global pharmaceutical trade continues to grow, the demand for reliable identification and monitoring solutions is expected to accelerate, making RFID technology a key driver for ensuring safe and efficient pharmaceutical operations.

I. Rapid RFID Statistics for the Pharmaceutical Market

| Measurement | Value |

|---|---|

| Estimated value of the RFID market in the pharmaceutical sector in 2025E: | US$6.2 billion |

| Projected value of RFID in the pharmaceutical market in 2035F: | US$18 billion |

| CAGR forecast (2025-2035) | 11.2% |

II. Segmented Analysis

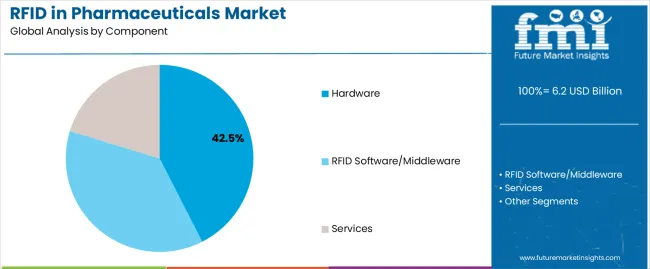

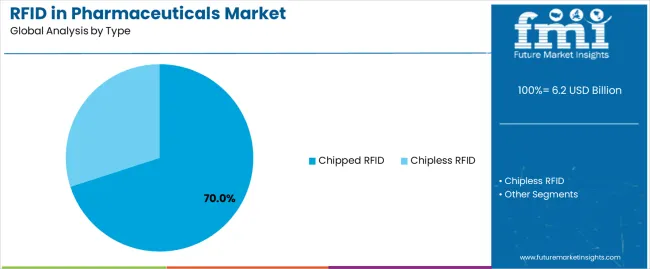

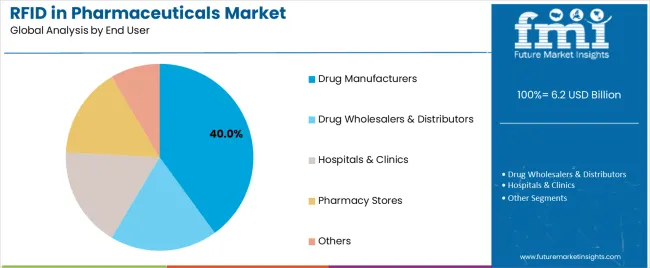

The market is segmented by component, type, end-user, and region. By component, the market is divided into hardware, RFID software/middleware, and services. By type, the market is divided into RFID chip-based and chipless RFID. By end-user, the market is segmented into pharmaceutical manufacturers, pharmaceutical wholesalers and distributors, hospitals and clinics, pharmacies, and others. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, the Balkans and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and the Pacific region, and the Middle East and Africa.

1、Insights into hardware component sub-sectors

The hardware segment is projected to account for 42.50% of the RFID pharmaceutical market revenue share by 2025, making it the leading component segment. This segment’s growth is driven by the ongoing deployment of RFID readers, RFID antennas, and tags, enabling precise tracking of pharmaceuticals throughout the supply chain.

Hardware components form the foundation of RFID systems, providing accurate and efficient identification and real-time monitoring of inventory movement. The growing demand for high-performance, compact, and cost-effective RFID tags is driving the adoption of advanced hardware infrastructure in pharmaceutical logistics.

Furthermore, continuous innovation in tag miniaturization and read range capabilities enhances the efficiency of cold chain monitoring and asset management. The increasing need for continuous visualization and error-free data collection makes hardware solutions indispensable for pharmaceutical tracking, solidifying its market leadership.

2、Insights into the segmentation of chip-based RFID types

The chip-based RFID segment is projected to account for 70.00% of the RFID market revenue by 2025, establishing its dominant position in the segment. This dominance is driven by the superior data storage capacity and higher read accuracy of chip-based RFID systems, which are crucial for pharmaceutical applications requiring high traceability.

The ability of chip-based RFID tags to store critical product data, including batch numbers, expiration dates, and country of origin, significantly enhances inventory verification and compliance. Their reliability under high-temperature or high-humidity conditions further drives their widespread adoption in pharmaceutical packaging and logistics.

The integration of smart packaging technologies with automated supply chain systems is also accelerating the preference for chip-based RFID solutions. As the pharmaceutical industry continues to embrace digital transformation, demand for interoperable and data-secure chip-based RFID tags is expected to remain strong.

3、Insights into end-user segments of pharmaceutical manufacturers

The pharmaceutical manufacturing sector is projected to account for 40.00% of RFID revenue in the pharmaceutical market by 2025, becoming the leading end-user segment. This growth is primarily attributed to the increasing emphasis on product authentication, batch-level tracking, and compliance with serial number and anti-counterfeiting regulations.

Pharmaceutical companies are widely adopting RFID technology to improve the visibility of their production and distribution networks, ensure timely product delivery, and minimize losses due to theft or mislabeling. RFID systems provide real-time data analytics capabilities, enabling manufacturers to improve operational efficiency and ensure quality control throughout the manufacturing process.

Furthermore, the integration of RFID automation solutions supports predictive maintenance, optimized inventory management, and improved process validation. With increasing pressure on global supply chain integrity standards, pharmaceutical companies are expected to continue investing heavily in RFID systems, further solidifying their leadership position in this segment.

III. Semi-annual Market Update

The table below shows the projected CAGR for the global pharmaceutical RFID market across multiple half-year periods from 2025 to 2035. This assessment outlines the evolution of RFID in the pharmaceutical industry, identifies revenue trends, and provides key decision-makers with an understanding of the full-year market performance.

H1 represents the first half of the year, from January to June, while H2 represents the second half, from July to December. The first half of the year (2025-2035) is projected to have a CAGR of 10.7%, which will increase to 11.4% in the second half (2025-2035).

| Specifically: | Compound Annual Growth Rate of Value |

|---|---|

| First Half of 2025 | 10.7% (2025-2035) |

| H2 of 2025 | 11.4% (2025-2035) |

| First Half of 2025 | 10.4% (2025-2035) |

| H2 of 2025 | 11.6% (2025-2035) |

Looking ahead to the second half of 2025, the CAGR is projected to rise slightly to 10.4% in the first half and remain at a higher 11.6% in the second half. The market declined by 30 basis points per second in the first half and increased by 20 basis points per second in the second half.

IV. Key Industry Highlights

In the pharmaceutical market, RFID technology is increasingly focusing on supply chain transparency.

The increasing use of RFID technology aims to improve transparency in the pharmaceutical industry’s supply chain. This is because companies need to enhance the security, assurance, and productivity of their pharmaceutical supply chains. In a transparent supply chain, every step from manufacturing to the user is continuously monitored.

In the pharmaceutical industry, product integrity is paramount, and RFID technology is becoming a key tool for achieving this transparency.

RFID technology allows companies to track products in real time. It details the product’s location, mode of transport, and status throughout the supply chain. Each product has a unique RFID tag, which RFID scanners can read at different points in the supply chain.

This information is stored in a central system, enabling relevant stakeholders to monitor product dynamics in real time. This transparency is crucial for addressing issues such as counterfeit drugs, drug trafficking, and theft—major concerns for the pharmaceutical industry.

Furthermore, using RFID to make the supply chain more transparent helps companies comply with regulations. Most governments and regulatory agencies require companies to closely monitor pharmaceuticals to ensure their safety and accountability. RFID technology provides a reliable way to meet these needs, making compliance easier and reducing the risk of fines or legal trouble.

The crackdown on counterfeit drugs by various companies has spurred the development of RFID in the pharmaceutical market.

Combating counterfeit drugs is a major challenge for pharmaceutical companies, and RFID technology has emerged as a key tool in addressing this issue. Counterfeit drugs put patients at risk and undermine public trust in healthcare. They also generate significant financial losses for pharmaceutical companies. RFID technology offers a powerful solution by simplifying the tracking and inspection of drugs from manufacturer to user.

RFID tags are integrated into product packaging and carry a unique code for each item. These tags can store detailed information such as the product’s manufacturing date, batch number, and other critical data. RFID readers scan these tags at different points in the supply chain, allowing for immediate verification against a master database.

This approach ensures that every product can be tracked from manufacturer to end user, providing a clear and reliable journey record. If any discrepancies are detected, such as incorrect location or tampered packaging, the system can pinpoint these issues. This prevents the further spread of counterfeit drugs in the supply chain, driving the growth of RFID in the pharmaceutical market.

RFID’s real-time monitoring and tracking capabilities are particularly useful in areas with high counterfeit drug risk, such as international markets or regions with less stringent regulations. This helps pharmaceutical companies and regulatory agencies verify product authenticity, thereby reducing the likelihood of counterfeit drugs entering the market.

Furthermore, RFID technology is now being combined with new technologies such as blockchain to further enhance security. The immutable records of blockchain prevent data from being overwritten by RFID tags, adding another layer of security and transparency. This collaboration makes it more difficult for counterfeiters to smuggle counterfeit goods into the supply chain, as any attempt to tamper with data will be immediately detected.

Integration with the Internet of Things (IoT) has created opportunities for RFID in the pharmaceutical market.

The convergence of RFID and the Internet of Things (IoT) is revolutionizing the pharmaceutical industry. It makes supply chains more efficient, traceable, and secure. IoT connects devices that share information. When combined with RFID, it becomes a powerful tool for real-time monitoring and control of pharmaceuticals, creating opportunities for the expansion of RFID in the pharmaceutical market.

A key advantage of combining RFID and IoT technologies is the ability to comprehensively and continuously monitor pharmaceuticals and medical supplies. When RFID tags are connected to an IoT network, real-time information on the location, status, and flow of pharmaceuticals throughout the supply chain can be provided. This continuous visibility helps ensure products remain in optimal condition during storage and transportation.

This is crucial for drugs and vaccines that require specific temperatures. IoT-driven RFID systems can issue alerts when any condition is compromised. This allows for rapid problem resolution and reduces the risk of drug spoilage.

Furthermore, IoT integration impacts the data analytics capabilities of RFID systems. By collecting and evaluating bulk datasets of RFID tags, IoT platforms can provide vital information on supply chain performance, inventory levels, and product usage patterns. This data-driven approach enables pharmaceutical companies to improve operations, reduce waste, and increase predictive accuracy.

Technological challenges and regulatory uncertainties may impact the projected growth of RFID in the pharmaceutical market.

RFID systems use radio waves to communicate between RFID tags and readers. Other objects, such as metals, liquids, and other electronic devices, can interfere with these signals. This interference leads to poor tag readability, making it difficult to track products in the supply chain.

RFID tags also need to be rugged and durable, as they must withstand a variety of environmental conditions, including extreme temperatures, humidity, and physical forces. RFID tags must remain functional under these conditions.

Integrating RFID systems into existing supply chains is equally complex and time-consuming. It requires significant investment in hardware such as tags and readers. It also requires software to manage the data. Furthermore, employee training is needed to effectively use the new technology, which hinders the development of RFID in the pharmaceutical market.

In addition, unclear regulations can impede industry expansion. Governments worldwide are promoting better drug tracking methods, such as radio frequency identification (RFID), to maintain the safety and authenticity of drugs. However, regulations are constantly changing and vary from place to place. This makes it difficult for pharmaceutical companies to comply with all regulations.

For example, the United States has the Drug Supply Chain Security Act, while Europe has the Counterfeit Drugs Directive. Both require strict drug tracking, but the specific requirements and timelines are almost entirely inconsistent. This creates problems for companies in many countries. They had to develop different rules and adjust the RFID system to suit each one.

V. Comparison of Global Pharmaceutical RFID Sales Outlook from 2020 to 2024 and Demand Forecast from 2025 to 2035

The global pharmaceutical RFID market is projected to grow at a CAGR of 10.3% from 2020 to 2025. RFID’s growth in the pharmaceutical industry is robust, reaching $502.36 million in 2025, compared to $3.2855 billion in 2020.

The pharmaceutical RFID market is expected to grow between 2020 and 2025. Stricter regulations, the need for supply chain transparency, and companies’ efforts to combat counterfeit drugs are also driving this growth. In 2020, pharmaceutical companies began using RFID more extensively because it helped them better manage inventory and combat counterfeit drugs. New laws around the world are making medical products safer, prompting more companies to adopt RFID.

The COVID-19 pandemic accelerated the adoption of RFID technology in the pharmaceutical industry in 2025. The global health crisis demonstrated the critical importance of a strong and transparent supply chain for vaccines and essential medicines.

Governments and pharmaceutical companies are investing heavily in RFID technology to enable efficient distribution and effective tracking of COVID-19 vaccines. This has resulted in a significant leap in market growth, with RFID becoming a key tool in the fight against the pandemic.

Following the pandemic, the market has continued to grow due to the emerging trend of regulatory enforcement regarding drug traceability requirements, prompting more companies to adopt RFID technology. Furthermore, increasing focus on cold chain management for temperature-sensitive drugs and vaccines has supported the demand for RFID solutions integrating sensors, driving strong market growth.

VI. Market Concentration

In the global pharmaceutical RFID market, Tier 1 companies hold a significant market share of 40% to 45%, making them market leaders. These companies have a large global presence, diversified product lines, and a strong focus on R&D investment.

They primarily set industry standards and introduce new innovations in RFID technology. Major Tier 1 companies include Avery Dennison, Hitachi, Honeywell International, Nedap N.V., and Zebra Technologies Corp.

Tier 2 companies are mid-sized enterprises and may not have the global reach of Tier 1 companies. However, these companies excel in their respective niche markets, primarily working with large companies to provide complete solutions.

Tier 2 companies offer a variety of RFID products and services designed for the pharmaceutical industry, focusing on tailored new ideas and solutions for each client. Notable Tier 2 companies include Alien Technology, LLC, CCL Healthcare, GAO Group, HID Global Corporation, and KATHREIN Solutions GmbH.

Tier 3 companies are small businesses and emerging startups that may lack the global customer network compared to Tier 1 and Tier 2 companies. These companies may offer customized RFID products, such as tags for specific purposes, or focus on services such as system integration and consulting.

These companies may specialize in RFID products, such as application-specific tags, or they may focus on providing services such as system integration and guidance.

VII. Views on division by country

The following sections provide industry analysis of the pharmaceutical RFID market in different countries. Market demand analysis is provided for key countries in several regions, including the United States, Germany, China, India, Brazil, and the United Kingdom.

The United States is projected to continue leading the North American market, reaching a value share of 71.2% by 2035. In East Asia, South Korea is expected to achieve a CAGR of 11.1% by 2035.

| Country | Compound Annual Growth Rate of Value (2025-2035) |

|---|---|

| United States | 10.5% |

| Germany | 10.0% |

| China | 11.5% |

| India | 11.9% |

| United Kingdom | 10.8% |

1、Supportive regulations for supply chain transparency are a good sign for growth in the U.S. market.

In North America, led by the United States, the RFID market share in the pharmaceutical industry is projected to reach approximately 77.5% by 2025. The US pharmaceutical RFID market is expected to grow at a CAGR of 10.5% during the forecast period.

In the US, several initiatives are underway to combat counterfeit drugs. These include developing guidelines for the use of RFDI in the pharmaceutical and healthcare industries. In July 2025, the regulatory body GS1 USA released new guidance.

These guidelines aim to promote RFID applications in the healthcare sector. They demonstrate how to encode RAIN RFID tags using GS1’s Electronic Product Code (EPC) scheme. This facilitates data collection and improves supply chain visibility.

2、The increase in pharmaceutical manufacturing facilities has driven the growth of China’s pharmaceutical RFID market.

The RFID market in China’s pharmaceutical sector is projected to achieve a CAGR of 11.5% between 2025 and 2035. Currently, it holds a significant market share in East Asia, and this dominance is expected to continue throughout the forecast period.

The rapid expansion of China’s healthcare industry provides a positive outlook for market growth. Several pharmaceutical companies are expanding their manufacturing capacity to meet growing domestic demand. For example, in March 2025, Novo Nordisk invested approximately US$556 million in its Tianjin plant in China to expand its sterile formulation production capacity.

This expansion is crucial for meeting the growing demand for Novo therapies, particularly semaglutide, a product experiencing significant market growth.

3、The significant expansion of pharmaceutical e-commerce in India supports industry trends.

The RFID market in India’s pharmaceutical sector is projected to grow at a CAGR of 11.9% during the forecast period, holding a significant market share in South Asia and the Pacific until 2035.

According to the Indian Brand Rights Foundation (IBEF), India’s domestic pharmaceutical network comprises over 3,000 pharmaceutical companies and approximately 10,500 manufacturing units. Furthermore, favorable policies are contributing to the increasing presence of pharmaceutical e-commerce companies in the country, creating a positive outlook for industry growth.

VIII. Category Insights

This section contains information on leading industry segments. By component, the services sector is projected to grow at a CAGR of 11.5% through 2035. Furthermore, the pharmaceutical wholesalers and distributors segment, categorized by end-user, is expected to expand at a rate of 11.6% until 2035.

1、The hardware segment dominates the RFID component market within the pharmaceutical industry.

| Components | Hardware |

|---|---|

| Value Share (2025) | 59.8% |

The hardware segment is projected to account for 59.8% of the component market share by 2025. Growth in hardware such as active RFID tags, passive RFID tags, and semi-passive RFID will primarily rely on their ability to efficiently transmit data to centralized systems and assist in robust inventory management.

Furthermore, fixed and handheld card readers also possess monitoring capabilities, enabling real-time product tracking and supporting growth in specific market segments.

2、RFID in the pharmaceutical field is mainly used by pharmaceutical manufacturers.

| End-user | Pharmaceutical manufacturers |

|---|---|

| Value share (2025) | 32.5% |

The pharmaceutical manufacturing segment is projected to account for 32.5% of the market share by 2025. Pharmaceutical manufacturers are significantly leveraging RFID to dramatically improve supply chain efficiency and product safety. It also helps streamline warehouse operations by automating inventory management, reducing errors, and optimizing inventory levels.

The technology also facilitates cold chain management for temperature-sensitive drugs, ensuring products remain under the required conditions throughout the supply chain.

IX. Competitive Landscape

In the pharmaceutical sector, major players in the RFID market are investing in advanced technologies and establishing partnerships. Key RFID suppliers in the pharmaceutical industry are also acquiring smaller businesses to expand their reach and further penetrate markets across multiple regions.

The latest industry developments of RFID in the pharmaceutical market

An in-depth look at the RFID printer market from 2025 to 2035, covering growth drivers, risks, regional trends, and real-world adoption across key industries.

MoreAn in-depth analysis of the global RFID market from 2024 to 2031, covering technology evolution, market structure, passive vs active RFID, and real-world adoption trends.

MoreRFID-integrated smart packaging market forecast from 2025 to 2035, covering market size, CAGR, technology trends, applications, and regional growth insights.

MoreAn in-depth analysis of the global RFID smart cabinets market, covering market size, growth drivers, technology trends, regional outlook, and real-world applications across healthcare, industry, libraries, and public safety from 2025 to 2033.

More